Carmel Valley is a community in San Diego county that has become one of the prime Neighborhoods for many reasons, from its privileged location just a short distance from the beach, it’s top ranking schools and it’s easy freeway access. It has fared better than many local areas through the Real Estate market ups and downs and continues to be a very sought after place to live.

- LOCATION

Carmel Valley is bordered to the north by the North City Future Urbanizing Area (NCFUA) and Pacific Highlands Ranch; to the south by Los Peñasquitos Canyon Preserve and Torrey Hills; to the east by Pacific Highlands Ranch and Del Mar Mesa; and to the west by Interstate 5 and Torrey Pines. Nearby is the Torrey Pines State Preserve, where one of two stands of the endangered Torrey Pine is found to occur.

While many people in the area are now referring to the entire 92130 zip code as Carmel Valley, the actual boundaries of the community remain unchanged from the original community plan. The remainder of the 92130 zip code is filled by the surrounding communities of Del Mar Mesa, Pacific Highlands Ranch, and Torrey Hills.

- HISTORY

The earliest inhabitants of the area are believed to have been the earliest settlers in the region. There have been some artifacts found along the Carmel Creek area that are said to belong to this Native American tribe, confirming their settlement in the area, however, little is known about their life in this region.

Later in time, around the 1800 to 1900 the area was known as “Cordero” in it is where we find “Ranchers” it is thus known as the Rancho Period. The main activity in the region was producing and trading cattle hides and tallow. This was immediately followed by a period of agriculture became the main trade. At this time in history, we had the California Gold Rush going at full swing and some of these gold rushers did come to settle in the area, among those settlers we had the McGonigle Family who acquired 2,040 acres of what is today known Carmel Mountain preserve. It was then that the area became known as “McGonigle Valley.

Around the 1890’s the sisters of Mercy came from San Francisco down to the region. When they established themselves in the area they gave medical care to the McGonigle family and established a dispensary in 1000 acre parcel of land that they purchased from the same family. They also established a dairy farm and a vegetable garden. They also built a three story Victorian home that has played different roles through out time, it played the role of housing orphans, dispensary for the nuns and that is what later became Mercy Hospital, it later became a private home and horse ranch and most recently, after the Carmelites land was divided in two by the passing of the 56 freeway in the middle of their land, the home became property of the Chabbad center and it is currently on sale. The other half of the property houses a Church and burial grounds.

This nuns from the Carmelite order and were instrumental in naming the area when they named a mountain “Carmel Mountain” and their ranch “Carmel Mountain Ranch” after it. That is how the area got it’s name.

However in 1975 the area was mapped out and a plan was established it was named the “North City West Master Plan” and the name of the area was changed to North City West.

Construction in the area began in 1983 and by that time the original name had stuck to the region and so in 1990 the local planing board change the name back to Carmel Valley. The area is designated with the 92130 zip code.

Today Carmel Valley has grown to include surrounding areas such as: Torrey Hills, Del Mar Mesa and Pacific Highlands Ranch.

- SHOPPING + ENTERTAINMENT

As of Today there are 3 main shopping Areas.

The largest is Del Mar Highlands Town Center It includes fast food restaurants such as Mc Donalds, El Pollo Loco and Rubio’s, it also has Red Robin, Sammy’s Pizza and Champagne bakery, Starbucks and Chuao chocolatiers. It is divided in upper and lower level and houses some clothing boutiques, Gepetto’s Toy store, an Aveda and a Barnes & Noble book store. It houses two major groceries stores, Ralphs and a Jimbo’s which is a more natural and organic store. This shopping center included the Carmel Valley Ultra star movie theaters, however they ar currently close for remodel and will re-open sometime this summer.

There is another shopping center called Piazza Carmel It is a smaller plaza that includes Souplantation, Villa Capri a Vons grocery store, some boutiques and banks. Across the street you will find a Shell Gas station and a Pat & Oscar’s restaurant.

The other shopping area is Torrey Hills Shopping Center located in the southern part of Carmel Valley, this plaza is the most recently built but it is also the smallest one, it has a Vons groceries store as well, Starbucks, an italian restaurant three banks and the Carmel Valley office of Windermere Exclusive Properties.

The Scoop is that there will be 3 more shopping areas built in Carmel Valley, 2 of them are expected to be big shopping centers. One is located on the corner of Del Mar Heights and El Camino Real right across of Del Mar Highlands Town Center and construction is expected to begin soon.

The other major shopping area that is expected to be built is in the Pacific Highlands Ranch Neighborhood, it is said that it will include some major department stores but no word yet on which ones or when it will be built.

Finally, in the corner of Carmel Mountain and Carmel Country, Pardee is building a new community, part of the land, the south-west corner of it to be precise, is designated to be commercial/retail, No word yet what stores will be there but it is a much smaller space.

There is also a little known secret, here is the Scoop there is an Organic Farm right in the middle of Carmel Valley called Sea Breeze Farms

Also coming to the neighborhood we have 3 restaurants opening their doors in 2011, all of the in Del Mar Highlands town center. Rimel’s Rotisserie, The Counter which will be a burger place, Searsucker a great downtown restaurant is also working on opening up a new restaurant as is Swirls, a yoghurt ice cream store.

The movie theater will re-open with a new concept of VIP theaters where patrons will be able to reserve their seat ahead of time and there will be drinks and dinner served to your seat.

There are many excerisze places that go from yoga and pilates studios to full out sport centers. There are 2 in particular that are worth mentioning:

Pacific Athletic Club – One of San Diego’s finest sports resorts.

The Training Club – An innovative, high energy, and fun workout facility, totally committed to creating exercise programs for groups and individuals.

- REAL ESTATE MARKET

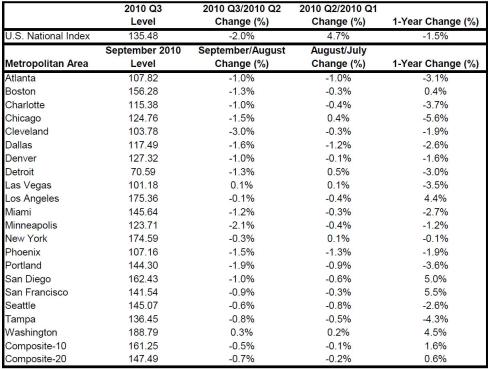

There are currently 230 Homes listed as Active

Here is a brief chart of the current listing statistics

out of which 160 are Detaches homes 70 are attached

There are 33 homes showing as contingent (this is a recently added status that means an offer has been accepted by the buyer and an approval is being negotiated with the bank in the case of a short sale)

There are 62 homes in escrow or listed as pending

In the past 30 days there were 35 homes that Sold here is a chart to view the stats of past months sale

out of those 35, 22 were detached homes and 13 were attached

There are 224 properties in the public records list of homes in some stage of Foreclosure, you can search foreclosures here

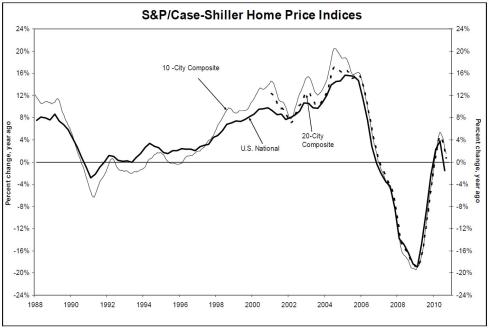

In general this area has fared very well thru the Real Estate market downtown.

You will be able to find many different communities within the area and prices go from $205,000 to $7,980,000 but the average sales price is around $1,ooo,000. If you want to look for homes in this area be sure to check out this site

- SCHOOLS

ELEMENTARY

There are 3 main School District operating in the area as far as elementary schools go.

|

|

MIDDLE SCHOOL

Both Solana Beach and Del Mar Union school districts merge when it comes to upper grades but Poway remains separate. We have:

|

|

And Poway Unified School District

HIGH SCHOOL

|

|

And Poway Unified School District

Only a very small section of Carmel Valley falls into the Poway School District designated boundaries and most people don’t even know that this is the case, so make sure you confirm that the home you are considering moving into falls into the boundaries of the school district that you are looking for. All of the schools in the area have received top rankings you can check the scores in this CA state website

You will also find Private schools in Carmel Valley:

|

|

If you have any other questions about Carmel Valley, would like any additional information or want information in any of the surrounding areas please feel free to contact me at : info@SanDiegoExclusiveProperties.com

You must be logged in to post a comment.