One of the Most beautiful areas in San Diego is an area called Del Mar, it is nestled between the Pacific ocean and the Freeway 5. Home to the World Famous Torrey Pines Golf Course as well as the Del Mar Fairgrounds Racetrack. It is an area filled with history and most of all natural Beauty. Home to many artist and personalities. It is among the most exclusive communities in San Diego and it is known for having the feel of a small town, with beautiful and very unique homes. The breathtaking views don’t hurt either. As if all that was not enough incentive to jus buy a home and move here, it also has some of the highest ranking Public Schools, from Elementary all the way to High School.

Every time I have had the opportunity to sell a home in this beautiful area I am reminded of how lucky I am to be able to work in this part of the world.

I have compiled a brief snapshot of this area, including its History, some pictures and the state of its Real Estate Market.

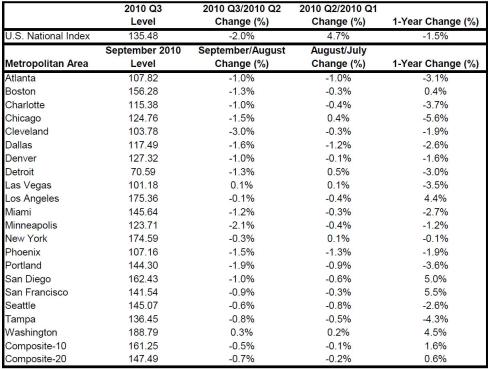

According to the local Multiple Listing Service, Del Mar California has the following statistics:

active Homes(for sale): 191________144 Detached________47Other

Contingent Homes: 7_________1 Detached_________6 Other

Pending Homes: 20________15 Detached _________5 Other

Sold Last 30 Days: 12________9 Detached_________3 Other

The averages for the properties that sold the last month are as follows:

72 Days On Market

95% Of the asking Price (SP/AP)

$718.10 per S.F

$1,677,150.00

This are the Statistics for the properties currently listed for sale:

126 average _______________2 to 1,212 Days On Market

$970.25 average___________$223.37 to $7315.79 Price per S.F.

$2,679,000.00 average_____$164,900 to $61,000,000.00 Asking Price.

The Most expensive listing in Del Mar can be viewed in one of my previous post Top 10 Most expensive Homes For sale in San Diego .

It happens to be the #1 MOST expensive home currently for sale in all of San Diego!

I have driven up and down the stretch of Hwy 101 that extends from Carmel Valley Road up to Via de La Valle hundreds of times. It is one of my favorite areas of San Diego yet, I had never questioned how it all came to be.

I have driven up and down the stretch of Hwy 101 that extends from Carmel Valley Road up to Via de La Valle hundreds of times. It is one of my favorite areas of San Diego yet, I had never questioned how it all came to be.

This piece of heaven also called Del Mar California has the feel of a European medieval town, with the atmosphere of a small community and some of the most stunning ocean views that never end.

So, how did it all get started? When did it begin?

I found some information on Del Mar ‘s history through it’s own historical society.

According to documents found the date when you could say everything was set in motion was on August 14 1882, the day the railroad tracks were laid along this stretch of coastline in the effort of uniting San Diego and San Bernardino.

The man in charge of overseeing the project was Theodore M. Loop, an engineer and contractor. He set up camp in a beautiful parcel of land that he referred to as “the most attractive place on the entire coast”. At first this man had laid down a tent city and right away built a house for himself and his family. It was his wife Ella who named it, Ella, called it “Del Mar” – words taken from a popular poem, The Fight on Paseo Del Mar.

Loop met a gentleman named “Colonel” Jacob Taylor who suggested they develop the area and build a town here. It was 1885 when he purchased 338.11 acres at the northern end of the mesa from homesteader Enoch Talbert. It is said that he paid $1,000. And at this, Del Mar was officially founded.

Taylor had a very clear picture in his mind of what the area was to become. His plan was for this to be a playground for the well to do, a seaside resort for the elite. The visionary designed and built a town whose focal point was Casa del Mar, a hotel-resort. Other town attractions included a natatorium, dancing pavilions, and a bathing pool extending from the beach out into the sea.In 1889 tragedy struck and the main attraction, the hotel, burnt down to the ground and so the town was left without it’s focal point. This together with the struggling economy left the small town in a dormant state for at least 15 years.

It was until the beginning of the 1900 when The South Coast Land Company hired a prominent Los Angeles architect, John C. Austin, to draw plans for a new hotel, the Hotel Del Mar. The hotel opened in 1910, and fulfilling the original plans for the area, the elegant hotel served as a magnet for Hollywood stars of the silent film days.

From 1912 till 1920 beautiful new homes began to appear around the new town and many of them soon became landmarks. Construction was halted in the 1930’s

Still it was during this time in 1933 when the search for a site to host the San Diego County Fair began. Ed Fletcher suggested that the 184 acre site in the San Dieguito Valley – just off the main highways and the Santa Fe Road – would be easily accessible and a perfect setting for a fairground.

It was on October 8, 1936 when the fair opened with an attendance of fifty thousand guests.

Bing Crosby made the Del Mar Turf Club a reality and Pat O’Brien became the Vice President. The Race track opened on July 3, 1937,and with it a new era began in Del Mar. The track was hailed as Bing’s Baby or Movieland’s Own Track. In 1938, Bing recorded the song that would open and close everyday of racing since those early days – Where the Turf Meets the Surf (click to listen to the song).

The race track brought A list celebrities and personalities every year, and many of them decided to set up homes in Del Mar, among them Lucy and Desi, Burt Bacharach and many others.

However during World war II the race track had to be closed and converted into a bomber tail assembly production facility until 1945 when racing returned to the the track.

The city of Del Mar was incorporated until 1959. During the following two decades everything was mostly quiet in the area. There was a growing movement of people in Del Mar whose goal was to beautify and maintain the open space, and it was at this time when the gorgeous Seagrove park with its grassy are overlooking the ocean was created.

Today the centerpieces of new Del Mar are L’Auberge – a beautiful hotel designed with the Stratford Inn in mind – and just recently renovated. And the elegant shops and boutiques of the picturesque seaside shopping center, Del Mar Plaza. Its selection of restaurants provides great taste, mood, and rave reviews.

Del Mar has maintained it’s picturesque main street, it’s small upscale town ambiance, with beautiful homes each one unique and different from the rest, some landmarks in their own right some brand new.

Today Del Mar Zip Code is 92014

For more detailed information you can visit my web site http://www.sandiegoexclusiveproperties.com/ or contact me by:

email info@sdexclusiveproperties

twitter www.twitter.com/rinapodolsky

facebook http://www.facebook.com/group.php?gid=123662939207&ref=ts

You can even search properties in Del Mar just by going to our web site

All the information in this blog has not been checked, it is believed accurate but not guaranteed.

Tags: buying a home in Del Mar, Del Mar History, Del mar homes, Del mar Homes for sale, del mar real estate, Del Mar Union School District, San Diego History, Selling a home in Del mar, Top San Diego Schools

You must be logged in to post a comment.