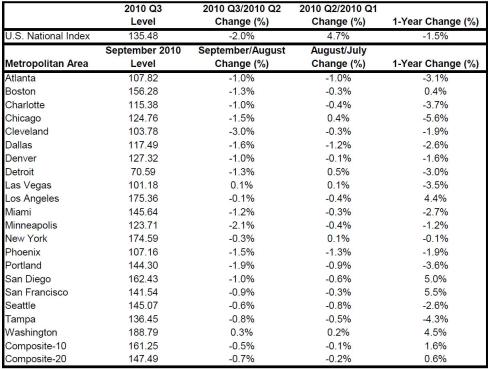

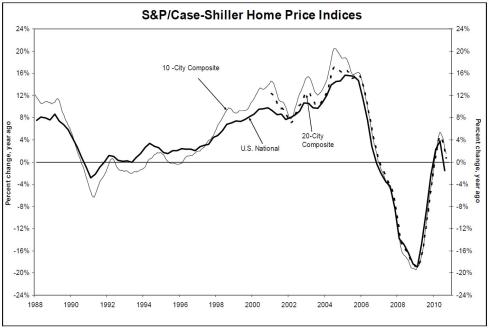

La Jolla’s zip code 92037 has remained for many years in the list of Most expensive Real Estate areas in the Country and the World. Today, the Real Estate Market in La Jolla has slowed down quite a bit just like many of the other most exclusive markets in the world, however it has not lost so much of its value. Here are the current statistics for the Real Estate market in La Jolla according to the Multiple Listing Service:

Active Listings: 400

Detached-217

Attached-183

Contingent Listings: 27

Detached-13

Attached-14

Pending (In escrow): 63

Detached-38

Attached-25

Sold in last 30 Days: 42

Detached-20

Attached-22

Of those sold in the last 30 days:

Average Days on Market-96

Average of Sale Price vs. asking price 96%

Average price per S.F.-$540.81

Average Price- $1,216,964

The most expensive Home Sold so far in 2010 was sold for $10,000,000

The most expensive Home Currently listed for Sale has an asking price of $29,500,000

This is what La Jolla Real Estate Market happens to look like today, but if you ever wonder, how did it all begin? Here is a brief look at the History of this Jewel so many people call home.

La Jolla is believed to have been inhabited by Native American cultures and there have been some artifacts that were found and conform this idea, however, there is no clear knowledge of who they were, and what happened to them. The earliest written records that have been found, are scattered records back from 1870, in which the spelling of the area was “La Joya” Which is consistent with the Spanish spelling of the word “Jewel, so it was called “The Jewel”. Some people have argued that the real name comes from the Native American term “Woholle” which means hole in the mountain.

Although there is no certainty of where the name came from, the idea of the area being called La Jolla after the word Jewell does make a lot of sense, it is certainly considered to be one pf the crowning Jewell’s to San Diego, with it’s breathtaking views of the ocean and its mansion lined streets, this area really shines.

This city was incorporated in the year 1850. 1869 is the year where they had the first recorded sale of land in this area, the purchase of these lots, called the “Sizer” lots, was made by two brothers. The cost of the land was $1.25 per ACRE, each brother bought a 80 Acre parcel of land on what is now Downtown La Jolla.

However, the first man to start auctioning pieces of land was Frank Terril Bostford, that earned him the nickname of “Father of La Jolla”.

This area went from having 350 residents in the year 1900 to having 4000 by the end of the World War I. The economic basis for this area was tourism.

Regarding it’s Architecture, it shifted from being mainly cottages to a Spanish Mission Style. However by 1929 with the Market crash and the economy collapsing, the area saw almost no new construction for the following 10 years. It was until the beginning of World War II that the area saw a new boom, this time the hills adjacent to this area were also includes in the new development of the area. At the end of the War, many people made thi area their home and a new growing spur was visible. The surrounding areas were made into subdivisions.

By 1960 La Jolla had 17,000 people calling it home and today there are about 40,000 residents.

Another historical fact that put La Jolla in the History books, was the fact that Charles Lindbergh learned to fly his gliders, flying out of the top of Mt. Soledad. Today, there are no Gliders flying out that same spot however there is very well known Glide Port in the Torrey Pines area right above the Scripps Institution of Oceanography.

And speaking about area attractions, there is the 7 caves at La Jolla Cove, today only 1 of the caves remains accessible but it is a favorite exploration spot for scuba divers and kayakers, there are many people who come to the area for both water activities.

AS far as Hotel’s go, Downtown La Jolla is home to “La Valencia Hotel” which was a destination hotel for many of the movie stars of the Golden Era, and it still remains today as one of the most exclusive hotels with a magnificent view of the ocean and a lavish Sunday Brunch that has become a tradition for localites.

It is no surprise that La Jolla, with its natural beauty has been the home and inspiration of many artist and writers. Perhaps one of the best known in the area would be Theodore Geisel A.K.A Dr. Seuss, his paintings can still be seen in some of the Gallery’s on Prospect St.

During the 1960’s La Jolla became the home of the prestiged school UCSD and the Salk institute, recognized also for its infamous architecture, designed by Louis I Kahn, one of the great Architects of that century.

Today, La Jolla remains a breathtaking upscale area where you can go see some of the most magnificent homes in the country.

Here is a Timeline of other interesting facts:

For any information on this post or any other post contained in this Blog please contact me at:

http://www.SanDiegoExclusiveProperties.com

or follow me in twitter: http://twitter.com/RinaPodolsky

You must be logged in to post a comment.