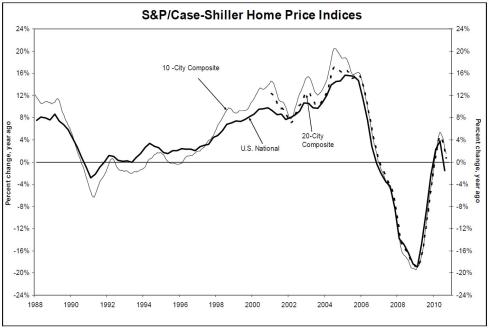

Have we seen the worst of the Real Estate Market slum or are we still on the way down? That is the main question that analyst are asked. As we begin 2011 there are many factors that will determine the behavior of this market on the year to come. Although there is no clear consensus, the majority of the experts predict that we are either bouncing at the bottom or on our way out of it, there are some that still predict a 5% slide in some areas. The Real Estate Market in some parts of California like Del Mar, and La Jolla are believed to be on their way out however to get a better understanding of what is ahead, here is a look at what experts look are looking at.

The determining factors that will come into play this year are mainly 4

- Unemployment.- Much of the markets bounce back is now hinging on this indicator. It is clear that if people don’t have jobs they will not be able to buy a home but it is also important to understand that even people who have a job need to feel that job is secure to feel they can take on the responsibility of home ownership. If the Job market gets stronger and companies start hiring instead of letting go of personnel that will help the housing market greatly.

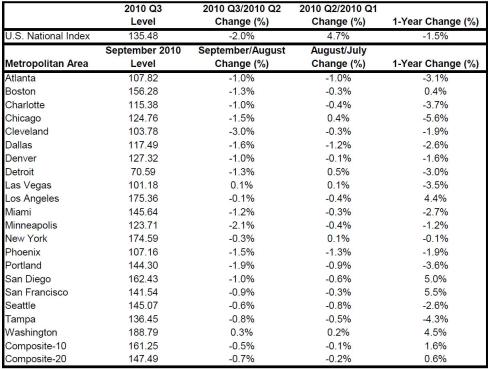

- Mortgage Rates.- Home affordability is now at a great level. One of the upsides to the National crisis is that with home prices having dropped an average of 29% nationally and Mortgage rates being at historically low levels, many people who could not afford to buy a home are now able to. Even though credit has been challenging to get and underwriters are being very strict with the loans, there is an important sector that does qualify in today’s market conditions that would not have done so before. Mortgage rates have gone up for five consecutive weeks, yet they still remain at a low level, if they continue to go up, the affordability will be affected and in those cases prices will need to adjust down so that buyers can continue to buy. If the rates remain steady then prices will most likely do the same.

- Home Inventory.- There has been a lot of talk regarding the large inventory of homes that are in some stage of the foreclosure process and of how those homes threaten to hit the market and like a new wave that consequently will bring prices down once again. It is very important that we understand some key differences between the situation of that first wave of foreclosures and the next one. After the market crashed, new construction came practically to a screeching halt. Builders main focus was to get rid of their inventory and they all but stopped planing new projects. Also, banks had no systems in place to deal with loan modifications, short sales and foreclosures. Not that what the banks are doing today can be considered efficient or a well oiled machine, but at least there are more systems in place. Banks also understand very well by now that if the market has a big slide, they, as property owners which they have undoubtedly become, will be very hurt. If instead, they control de speed and amount of foreclosed properties coming into the market, they are being greatly benefitted. Banks are more open to bulk transactions, homes are being sold more often at court steps, lenders are making some efforts to get short sales approved, loan modifications work. I do say some efforts because they are still very far from I would say they are efficiently doing either one of those.

- Government programs.- Last year the government implemented tax credits that were succesful in getting buyers off the fence and getting the Real Estate Market moving. Once those credits expired the market definitely stalled again, it did not stop but it certainly slowed down. The government has said that they will take a detailed look at two of the most important agencies. Fannie Mae and Freddie Mac will be revised and the president has said that in the coming months there will be some serious changes to both. That will very likely have an effect on how the market behaves, specially since in todays market, it is said that 9 out of 10 loans are backed by one of those two agencies. Emile Haddad, chief executive of FivePoint Communities Inc said that due to this key factor he believes the market will remain steady for all of 2011.

One thing I do know is that I agree with Richard Green, director of the USC Lusk Center for Real Estate, the recovery will not happen evenly across the country and talking about California’s Real Estate recovery in particular it will happen in the areas near the coast first and way before the areas like Riverside or San Bernardino. Once again we go back to Real Estate’s cardinal rule, Location, location, location! As he explains itat there are not enough high earning people in the later areas whereas Del Mar, La Jolla, Newport, San Francisco, Beverly Hills, etc. as he said

” A place like Silicon Valley, or a place like West Los Angeles, there is a critical mass of very high-income people.… That means you have a large number of people who can afford to spend in the neighborhood of $1 million on a house, and these are desirable places.”

So he believes that these areas will se a return to their peak levels within 5 years, where the other areas, will take much longer and will have to change the product they offer to cater to a different income market before they can see a comeback.

The one thing that most if not all experts agreed on is that bottoms are really hard to pinpoint, usually people can only see the bottom when the uptick is already strong. The one thing that is clear is that this a good time to buy, specially because of the combination of low prices and low mortgage rates that will not be seen in many years to come.

If you have any further questions or for information regarding The San Diego Real Estate market you can go to our web site www.SanDiegoExclusiveProperties.com or contact us and we will be happy to help.

You must be logged in to post a comment.